BOULDER COUNTY COLORADO

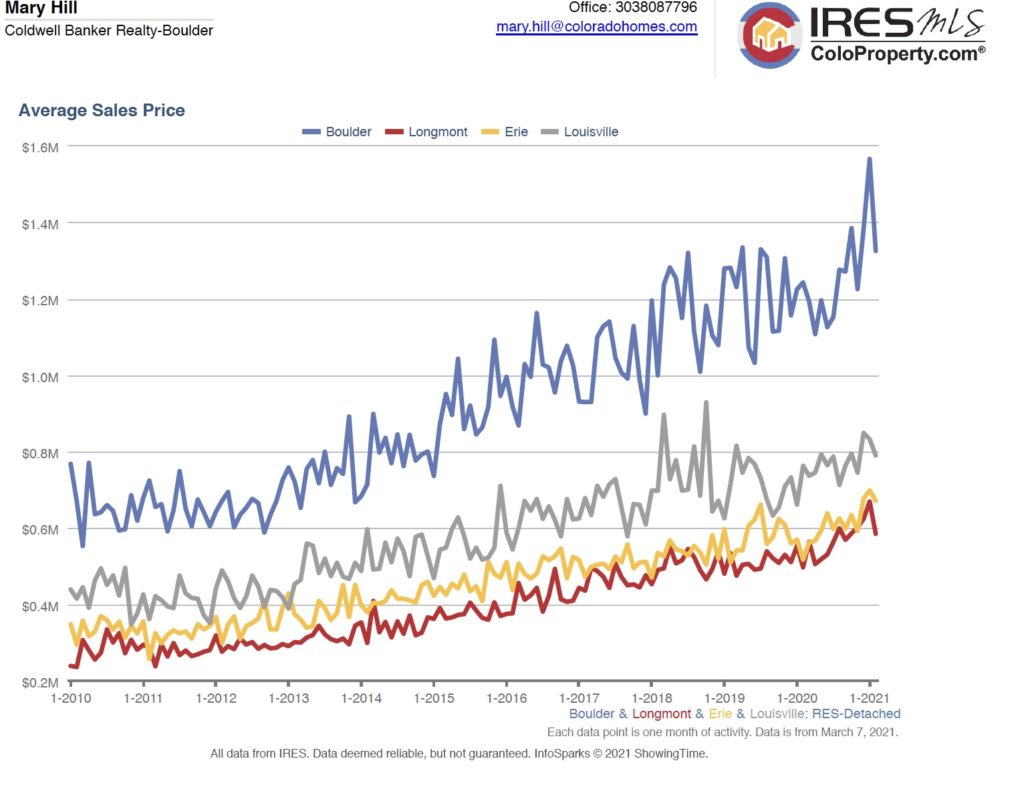

The Boulder County real estate market continues to be strong compared to 2020. However, the average price of sold SFR homes declined in all towns surveyed between January and February 2021 except for in Lafayette. Closed sales declined as well while the average price per square foot increased compared to a year ago.

BOULDER

Buying a home in Boulder in February 2021 was less costly than in January 2021. This occurred even with less than a month’s supply of homes for sale and 64 homes sold. Boulder again led the county with an average sales price of $1,325,362.

ERIE

A surge in home prices also occurred in Erie compared to 2020 (up almost 30 percent). This correlated to an increase of 31 percent in price per square foot. However, the average price declined 3.9 percent compared to January 2021.

LAFAYETTE

Lafayette SFR homes sales defied the trend and increased in price between January and February 2021. Lafayette had the largest decline in total sales which may have contributed to the price increase since the previous month. The average price was up 26 percent since last year.

LONGMONT

The average price of a home in Longmont was $584,977 down $84,344 since January but up 18 percent since February 2020. Longmont continues to see a dismal inventory of homes for sale and a dramatic decline in homes sold.

LOUISVILLE

Good luck finding a home for sale in Louisville. As of this writing there were NO homes for sale in Louisville. Last month the average price of SFR in Louisville was $790,133 up 3.5 percent since February 2020 but down 5.1 percent since January 2021.

Average Sales Price Single Family Home

ANALYSIS

What is going on in the Boulder County real estate market? Real estate agents throughout the United States are seeing this same trend of not enough inventory and multiple offers within days of a house being listed.

With the onset of spring the inventory of homes on the market typically increases. (Are you listening sellers?) The interest rates have begun to increase, erratically, with huge fluctuations in rates hour to hour. The combination of these two phenomena should create a more normal real estate market and a normalization of prices. But we shall see!